Core Banking Modernization Services

Built a data warehouse which consolidates data from 20+ systems including two core banking platforms for accurate regulatory & operational reporting. The engine streamlines ETL, validation, and BASEL II compliance, supporting both daily operations and long-term MIS strategy.

Built a clickstream analytics platform for CRM and risk modeling across digital channels. With 1PB+ of behavioral data, 900+ predictive triggers, and integrations with external sources, the solution improves loan targeting, boosts campaign conversion, and sets the foundation for real-time engagement.

Replace rigid core systems with agile platforms that support personalized experiences & operational agility.

Decompose monolithic cores into BIAN-aligned, event-driven microservices that enable faster change, better integration, and domain-led agility.

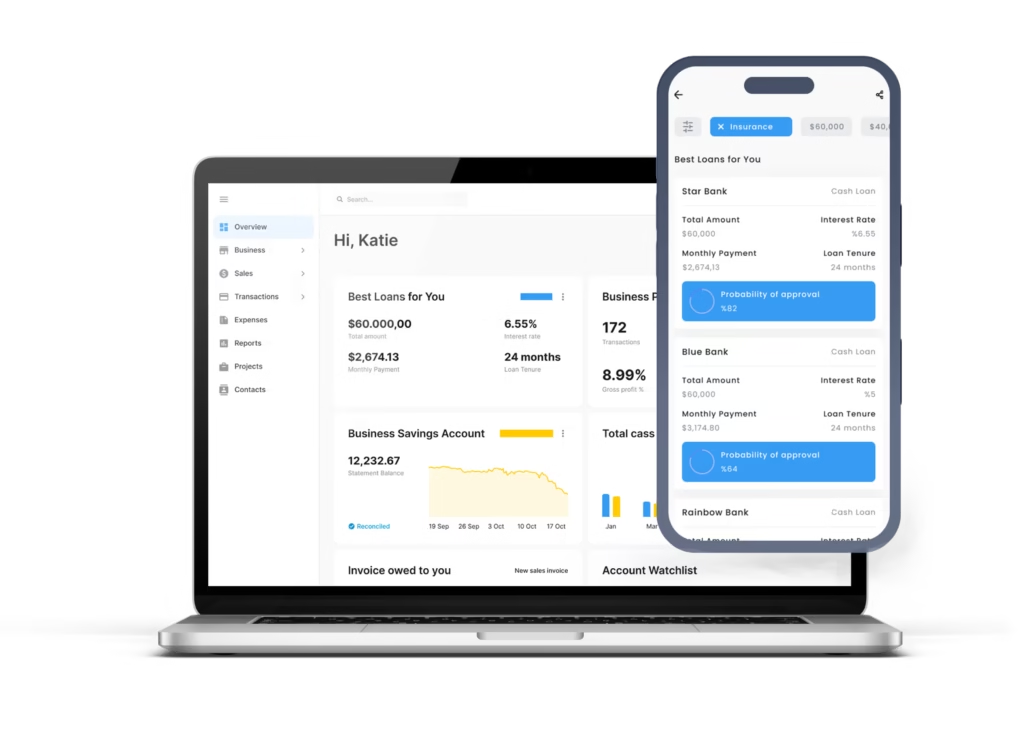

Leverage core banking data for real-time behavioral insights, smarter risk decisions, and personalized customer engagement.

Support phased transformation strategies; whether via greenfield, build vs. buy evaluations, or wrapping legacy with APIs and middle layers.

Support migration to next-gen core systems (e.g., Temenos, Mambu) or or re-engineer existing platforms using Java Spring Boot, Kafka, and Kubernetes with zero-downtime upgrades.

Improve availability, reduce tech debt, and enable continuous delivery with blue-green deployments and reusable architectural patterns.

Unify fragmented core systems across regions to drive consistent customer experiences, streamlined operations, compliance layers, and lower total cost of ownership.

Migrate COBOL and PL/I workloads to microservices or Java-based architectures, using phased replatforming or containerization strategies.

Adopt phased modernization with side-by-side systems, blue-green deployments, and robust rollback strategies to ensure business continuity.

Move from on-prem mainframes to hybrid or full-cloud models (e.g. Azure, AWS, GCP) to enable elasticity and lower infrastructure costs.

Senior Technology Director & Board Member

SVP, CIO of Global Commercial Services. Previously CTO at Kabbage, Acquired by American Express

«Kabbage’s (Acquired by American Express) partnership with Alpha Dynamiks has been instrumental in completing our goals across numerous major projects.»

Chief Operating Officer & Board Member

«Alpha Dynamiks has been cooperating with BNP Paribas since 2012, completing many initiatives with the bank, providing and implementing software that was developed especially for our needs.»

Chief Innovation Officer

«We have been cooperating with Alpha Dynamiks since 2016. The main project created by Alpha Dynamiks for our company was implemented very quickly – in only 13 months.»

Managing Director

«Alpha Dynamiks’s team was able to understand our business needs and set up a development team quickly and to a high quality.»

Head of Mobile Engineering & Quality Assurance

Chief Technology Officer (CTO)

«The team has been great to work with, they are direct communicators, open to feedback and work hard to build a great product.»

Pricing Manager

«Alpha Dynamiks’s team clearly understands our needs, have top-notch expertise both in our sector (FMCG), as well as the technologies used – Business Intelligence Data Warehousing.»

Don't hesitate to reach out! Our team is here to help.

Have an RFP or issues viewing the form?

Please reach out to us here by email.

If you’re interested in exploring how we can work together to achieve your business objectives & tackle your challenges – whether technical or on the business side, reach out and we’ll arrange a call!