FinCrime, Risk, and Regulatory Compliance Optimization Services

BNP Paribas automates KYC & AML workflows at scale with a modernized application, handling 100,000 monthly assessments across 700+ branches. The system integrates with customer-facing and back-office platforms, eliminating manual data re-entry and improving efficiency.

Through exploratory analysis and predictive modeling of contract and customer data, we delivered actionable recommendations across credit risk, churn prevention, and customer lifetime value, laying the base for data-driven decision-making and long-term analytics initiatives.

Automate and strengthen compliance across KYC, AML, and regulatory reporting while reducing operational costs.

Strengthen data governance, build data competencies, and unify data sources across the firm to support smarter, compliant decision-making.

Leverage AI/ML, RPA, NLP, and advanced analytics to automate risk surveillance, compliance processes, and fraud detection.

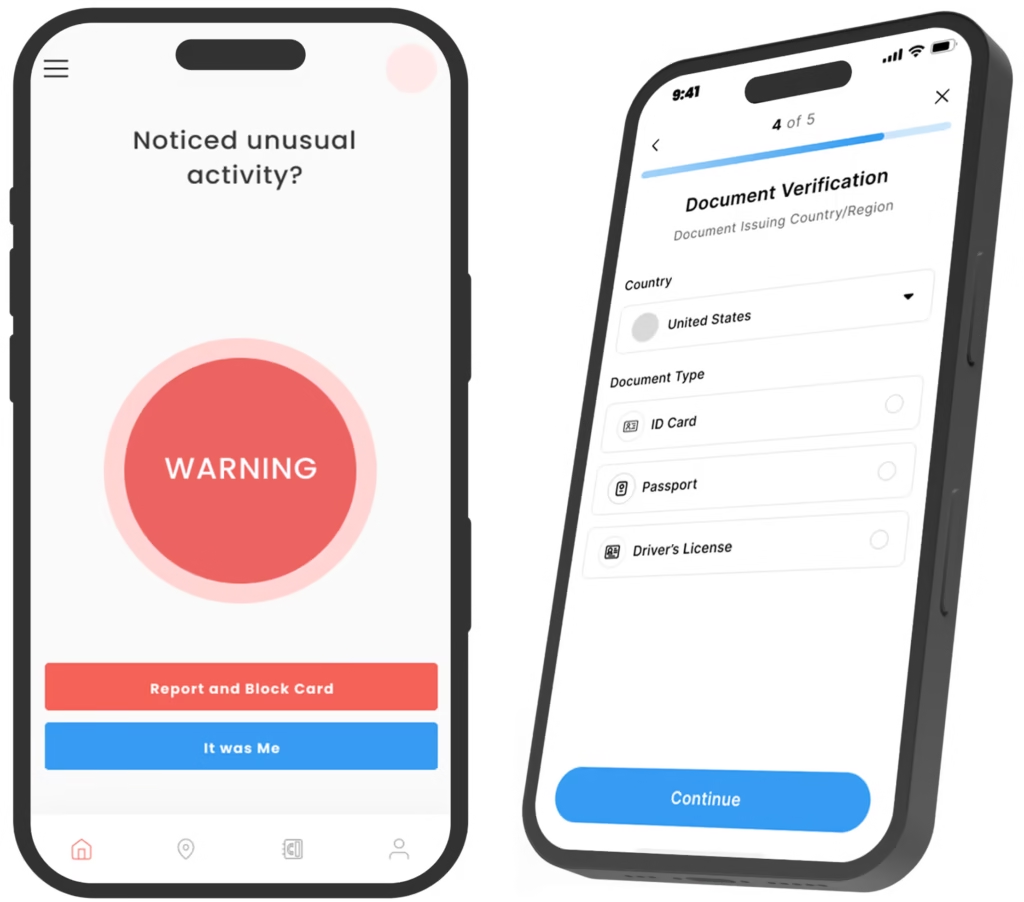

Digitize onboarding with omni-channel ID verification, dynamic KYC/CDD refresh, and significant reductions in onboarding times and false positives.

Simplify and modernize legacy systems across business lines, integrating KYC, AML, CLM, and transaction monitoring platforms.

Achieve 50–70% gains in onboarding and alert resolution times by reducing false positives and automating investigative workflows.

Enable near real-time surveillance, automated thresholding, anomaly detection, and intelligent alert triage through AI/ML accelerators.

Navigate multi-jurisdiction regulations, data privacy laws, and risk management practices with integrated compliance solutions.

Deliver measurable gains through operating model redesign, digital platform build-outs, FinCrime innovation sandboxes, and continuous improvement loops.

Senior Technology Director & Board Member

SVP, CIO of Global Commercial Services. Previously CTO at Kabbage, Acquired by American Express

«Kabbage’s (Acquired by American Express) partnership with Alpha Dynamiks has been instrumental in completing our goals across numerous major projects.»

Chief Operating Officer & Board Member

«Alpha Dynamiks has been cooperating with BNP Paribas since 2012, completing many initiatives with the bank, providing and implementing software that was developed especially for our needs.»

Chief Innovation Officer

«We have been cooperating with Alpha Dynamiks since 2016. The main project created by Alpha Dynamiks for our company was implemented very quickly – in only 13 months.»

Managing Director

«Alpha Dynamiks’s team was able to understand our business needs and set up a development team quickly and to a high quality.»

Head of Mobile Engineering & Quality Assurance

Chief Technology Officer (CTO)

«The team has been great to work with, they are direct communicators, open to feedback and work hard to build a great product.»

Pricing Manager

«Alpha Dynamiks’s team clearly understands our needs, have top-notch expertise both in our sector (FMCG), as well as the technologies used – Business Intelligence Data Warehousing.»

Don't hesitate to reach out! Our team is here to help.

Have an RFP or issues viewing the form?

Please reach out to us here by email.

If you’re interested in exploring how we can work together to achieve your business objectives & tackle your challenges – whether technical or on the business side, reach out and we’ll arrange a call!