Insurance Modernization

Launched a unified API marketplace with real-time financial integration capabilities, helping corporate clients to automate payments, account visibility, and cash flow management in real time.

The solution supports 7 service categories – from account and payment services to webhook-based notifications – empowering clients to build scalable digital experiences.

ANZ launched BlueSpace, a secure sandbox platform enabling fintechs, startups, and institutional clients to rapidly test and validate digital banking solutions using synthetic transaction data and API plugins.

BlueSpace allows rapid prototyping without touching production systems, lowering onboarding friction and fast-tracking strategic partnerships.

Now able to offer services more openly thanks to hybrid cloud setup. Infrastructure scalability, implementation of best practices, high reproducibility after failures, and major reduction in maintenance costs of the solution.

Armadillo uses modern architecture to increase integration possibilities and interoperability, reduce time-to-market from 1 month to 2 weeks, enabling agile regional launches & enhanced customer insights.

Delivered a 13-month migration project, moving 4+ billion records and 3.2 million credit accounts across 9 source and 4 target systems. We achieved exceptional data integrity with only 14 rejected records (expected) and full real-time reconciliation across 650+ reports.

BNP Paribas consolidated systems ahead of a major merger by migrating 44,000 card accounts. We executed two dress rehearsals and delivered a migration with 900+ data mappings and 170 reconciliation rules in a weekend.

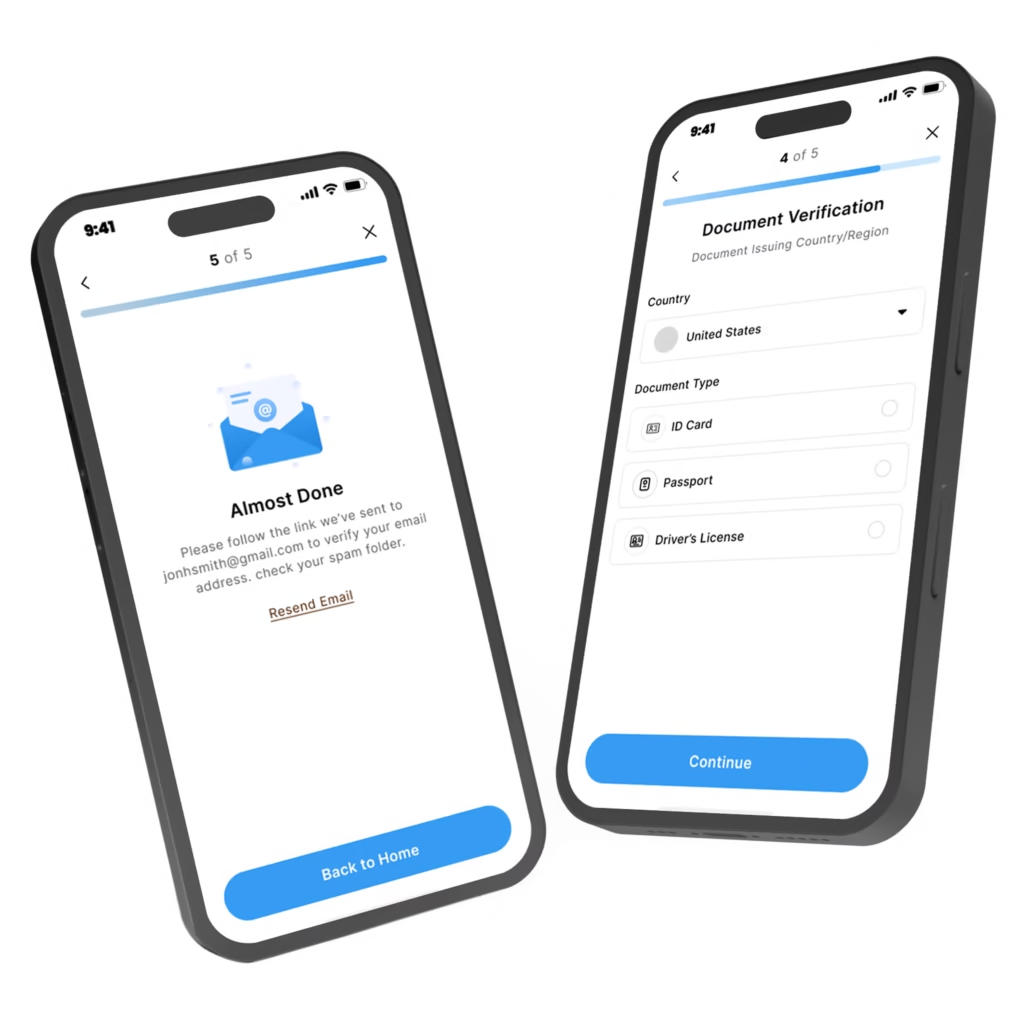

Designed & developed a Youth Banking platform for Greenlight, featuring functionalities such as instant money transfers, card issuing and management, cashback for kids, savings rewards, and more, in a mobile-first environment.

Built a data warehouse which consolidates data from 20+ systems including two core banking platforms for accurate regulatory & operational reporting. The engine streamlines ETL, validation, and BASEL II compliance, supporting both daily operations and long-term MIS strategy.

Built a clickstream analytics platform for CRM and risk modeling across digital channels. With 1PB+ of behavioral data, 900+ predictive triggers, and integrations with external sources, the solution improves loan targeting, boosts campaign conversion, and sets the foundation for real-time engagement.

BNP Paribas automates KYC & AML workflows at scale with a modernized application, handling 100,000 monthly assessments across 700+ branches. The system integrates with customer-facing and back-office platforms, eliminating manual data re-entry and improving efficiency.

Through exploratory analysis and predictive modeling of contract and customer data, we delivered actionable recommendations across credit risk, churn prevention, and customer lifetime value, laying the base for data-driven decision-making and long-term analytics initiatives.

Transform the insurance value chain - distribution, underwriting, policy servicing, and claims - through AI, digital ecosystems, and embedded models.

Enable omnichannel distribution, embedded insurance, and mobile-first onboarding through API-ready platforms integrated with third-party ecosystems.

Support real-time, behavior-driven models (e.g., pay-as-you-drive, event-based coverage) by integrating with IoT, mobility platforms, and BaaS partners.

Automate FNOL, fraud detection, and claims adjudication using AI/ML models, image analytics, and NLP-based documentation processing.

Migrate from legacy PAS to modular, cloud-native systems using microservices, configurable rules engines, and automated testing frameworks.

Accelerate underwriting with predictive analytics, AI-assisted decision support, and unified risk data from CRM, IoT, and external sources.

Enhance retention with intelligent nudges, proactive alerts, and contextual product recommendations across mobile, chat, and web channels

Senior Technology Director & Board Member

SVP, CIO of Global Commercial Services. Previously CTO at Kabbage, Acquired by American Express

«Kabbage’s (Acquired by American Express) partnership with Alpha Dynamiks has been instrumental in completing our goals across numerous major projects.»

Chief Operating Officer & Board Member

«Alpha Dynamiks has been cooperating with BNP Paribas since 2012, completing many initiatives with the bank, providing and implementing software that was developed especially for our needs.»

Chief Innovation Officer

«We have been cooperating with Alpha Dynamiks since 2016. The main project created by Alpha Dynamiks for our company was implemented very quickly – in only 13 months.»

Managing Director

«Alpha Dynamiks’s team was able to understand our business needs and set up a development team quickly and to a high quality.»

Head of Mobile Engineering & Quality Assurance

Chief Technology Officer (CTO)

«The team has been great to work with, they are direct communicators, open to feedback and work hard to build a great product.»

Pricing Manager

«Alpha Dynamiks’s team clearly understands our needs, have top-notch expertise both in our sector (FMCG), as well as the technologies used – Business Intelligence Data Warehousing.»

Don't hesitate to reach out! Our team is here to help.

Have an RFP or issues viewing the form?

Please reach out to us here by email.

If you’re interested in exploring how we can work together to achieve your business objectives & tackle your challenges – whether technical or on the business side, reach out and we’ll arrange a call!